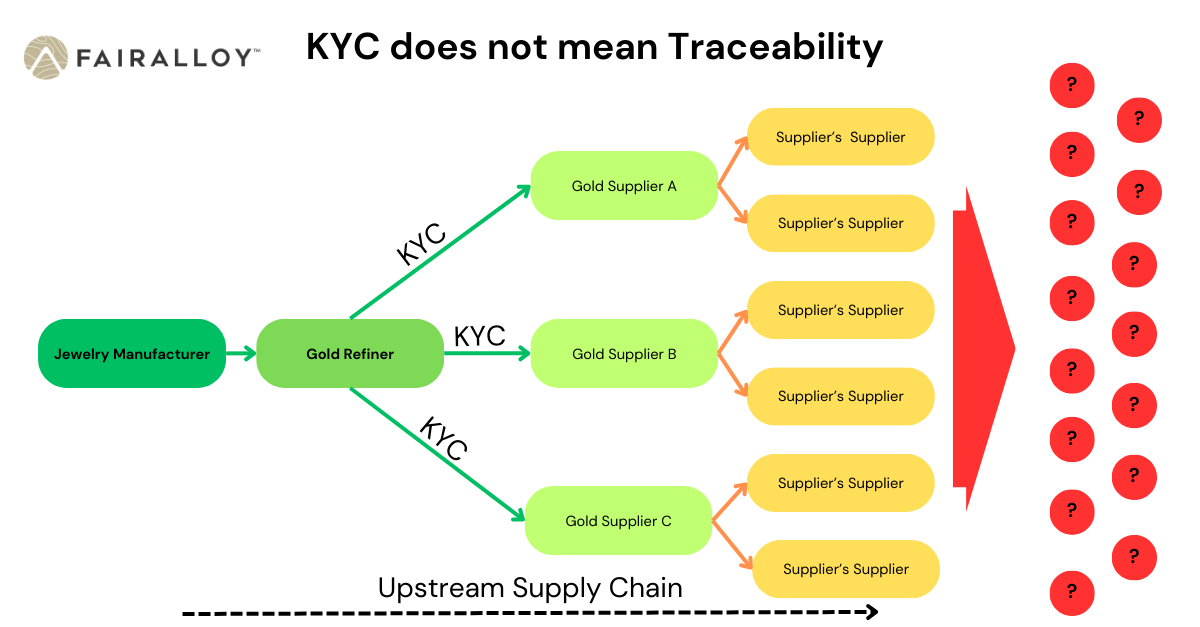

The application of KYC (Know Your Customer) is the fundamental pillar of widely adopted gold supply chain standards, such as RJC Chain of Custody, LBMA Responsible Sourcing Programme, Responsible Minerals Iniciative among others. However:

What is KYC? Does this practice help in determining the origin of gold? And why should I be interested in this if I am in the gold industry, jewelry, and similar sectors?

Companies can conduct due diligence processes on both their customers and suppliers. However, in this article, as the goal is to establish how KYC is utilized upstream, our focus will be on the supplier-oriented process

What is KYC?

KYC stands for Know Your Customer/Counterparty is a business practice aimed at reducing the risk of doing business with individuals or companies associated with criminal activities. This practice prevents the company from being economically affected by legal processes or damage to its reputation. Therefore, it is undoubtedly a highly recommended practice for any company, especially in an industry with such a high risk of money laundering, like the gold industry.

KYC is part of the due diligence procedures established in the banking sector, consolidated in agreements like Basel III, which have been adapted for use in other industries. Organizations such as the OECD have published guides guiding the gold sector on how to apply Due Diligence.

How is KYC applied in the gold industry?

In summary, the KYC process is generally as follows:

- The company defines the criteria that will be periodically evaluated for suppliers and how this evaluation will be conducted. As a guide, references are taken from the standards being adopted, which provide multiple recommendations on aspects to evaluate. I emphasize the word “recommendations,” and I will come back to this later.

- Companies segment their suppliers based on criteria they establish themselves. As a result of this segmentation, critical suppliers are defined, and a “more stringent” KYC is conducted on these critical suppliers.

- In most cases, KYC involves verifying that the company’s incorporation documents are “reasonably” legitimate and that the representatives, officials, and major shareholders of the supplier are not listed in restrictive lists or have open legal proceedings.

- The evaluation of critical suppliers depends on the criteria and budget of the company. It is common to request additional documents, such as a money laundering policy and financial statements, or in some cases, a physical visit to the supplier may be conducted.

- After the supplier is approved, some agreements are signed in which the supplier commits to engaging only in legal activities.

Limitations of KYC regarding the traceability of the origin of gold

Design and Scope of KYC

KYC evaluates the supplier, not individual transactions, as this is not its goal. For traceability to exist, the origin of each purchase made by the supplier must be known. What KYC achieves in the gold industry is transferring the risk to another link in the chain, which undergoes some verifications without the need for an audit. In no case is it possible or the goal of this tool to know the true origin of the material.

Subjectivity

Each company adapts its Due Diligence procedures according to its size, geographical location, volume of operations, etc. In practice, this means that companies may perform very deficient verification processes. Subjectivity arises because standards present recommendations, not obligations, and risk assessment must be tailored to each specific company.

Example:

To illustrate this, consider how a company might subjectively and ineffectively assess risks: Goldmetal Corp, a gold refiner, has two suppliers. Supplier A is located in Colombia and is a regulated mining company. Supplier B, located in the United States, collects gold it labels as recycled from multiple suppliers both in the U.S. and abroad.

According to the company’s evaluation criteria, the Colombian company is riskier due to its location, so they conduct a visit to the supplier’s facilities in Colombia. After a visit to the offices, mine, and a small tour, nothing suspicious is found, and Supplier A is approved. In contrast, the US-based company, Supplier B, overcomes the KYC process by only providing incorporation documents and tax registration.

Unfortunately, for this example, Supplier B primarily purchases from a group of pawnshops used by illegal gold smugglers who sell gold in the U.S., extracted in Venezuela and bought in Aruba. There is no evidence of these transactions as they are all conducted in cash. The most regrettable part is that even if Supplier B had been classified as a critical supplier, it would still not be possible to detect that the gold it trades is of illegal origin.

In conclusion, can traceability be guaranteed through the application of KYC?

The conclusion is No. KYC (Know Your Counterpart/Customer) is an essential practice for an industry with a high risk of money laundering, such as the gold industry, but it is only the first step in the pursuit of traceability. The major drawback is that KYC is only a subjective evaluation, not seeking to trace the origin of raw materials, and companies can adjust KYC according to their criteria, needs, interests, or limited knowledge of the industry.

Instead of just enhancing the surface-level KYC process, I suggest implementing comprehensive due diligence throughout the entire supply chain, complete with detailed mapping. This means meticulously identifying and assessing all participants in the supply chain, from upstream sources to the specific origins—particularly crucial in cases like recycled gold, where individual sellers are involved. We acknowledge that the due diligence standards prevalent in the banking sector may require substantial adaptation by the gold industry.

Extending supply chain due diligence to cover the entire chain won’t fully ensure traceability. However, it’s a positive move forward